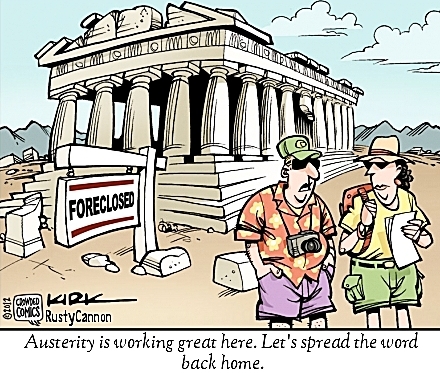

Greece cannot fall all by itself. It likely will bring the end of the Eurozone and create significant problems for the US. The Eurozone is a noble experiment but it is run by an international cartel of incompetents.

Greece cannot fall all by itself. It likely will bring the end of the Eurozone and create significant problems for the US. The Eurozone is a noble experiment but it is run by an international cartel of incompetents.

The Troika is nominally in charge. It is composed of the European Central Bank (ECB), the International Monetary Fund (IMF) and the European Commission (EC). In fact they dare not challenge the Teutonic Ego, as exemplified in Chancellor Merkel. Yes, Germany is in complete control of this coterie of clowns.

If the name James K. Galbraith has a familiar ring to the older readers, it may be because of his father, the eminent economist, John Kenneth Galbraith. Jamie followed in his father’s footsteps. He is a professor in the field at the University of Texas. He is also a close colleague of, and co-author with, the recent finance minister of Greece, Yanis Varoufakis. He has just returned from Greece.

Professor Galbraith can offer an insight into what is really happening behind the scenes, Alexis Tsipras, the prime minister of Greece, expected, as would you and I, to negotiate by offering a concession and receiving one in return. Sorry. The hubris of the German leadership doesn’t permit that.

German Foreign Minister Wolfgang Schäuble, long before, had actually told Varoufakis how it worked, or rather didn’t work. More “negotiations” only meant more concessions by Greece.

The Greeks made an offer. It was marked up in red ink and presented back by the EC president as an ultimatum. Tsipras and his government were elected because the populace was completely fed up with austerity. The Greeks could have just walked away; there was no possibility the people would allow them to accept that ultimatum.

Then came the surprise referendum. Had the vote been yes, the government would have had to resign. The people spoke, by a margin of more than 23 percent. Now, the government was forced by the electorate to hold firm, whatever the consequences. The Troika and the German government still don’t seem to appreciate how limited their options, nor the consequences of not lifting the austerity suffered by the Greeks.

The word appears to be that Germany not only is holding the Greeks’ feet to the fire, but actually adding more onerous conditions. Despite the essentially unanimous advice of leading economists, Germany is determined to tighten the screws. The message is clear. Germany doesn’t want capitulation. They want Greece out. They expect Greece to be a perennial underperformer that will always slow them down economically. The economists recognize the value of the Eurozone. Merkel’s goal is different. She apparently sees herself as Snow White, and prefers to be surrounded by dwarfs.

The word appears to be that Germany not only is holding the Greeks’ feet to the fire, but actually adding more onerous conditions. Despite the essentially unanimous advice of leading economists, Germany is determined to tighten the screws. The message is clear. Germany doesn’t want capitulation. They want Greece out. They expect Greece to be a perennial underperformer that will always slow them down economically. The economists recognize the value of the Eurozone. Merkel’s goal is different. She apparently sees herself as Snow White, and prefers to be surrounded by dwarfs.

Does Germany think, despite every indication to the contrary, that they can cull the weak sisters and maintain the Eurozone? That will not happen. Once the precedent of one member leaving or being pushed out is realized, it will be easier for others to leave or be pushed. Ireland, Portugal, Spain. Italy. All suffer from various degrees of the same malady that afflicts Greece.

The Conservative Party of the UK promised they will hold an in-or-out vote on membership in the European Union in 2016 or 2017. The Brits are not all that enamored of the EU to begin with. To see the turmoil and retrenchment develop and to see Germany ever more dominant is unlikely the Brits will elect to remain in an organization in such a state of disarray.

No one ever made their fortune betting on which path the French would take. Somehow, the French have maintained their pride. It’s difficult to imagine them playing permanent toady to Germany.

Greece is more than a troubled economic partner of Germany and the other EU members. Being on the underbelly of Europe, they are on the front line of the tidal wave of immigrants. The surrounding, former communist countries have sent as many as 600,000 commuting workers to Greece. This helps keep Albania and other countries bordering the EU quiet, relatively stable.

If Greece departs from the Eurozone there will be a domino effect, obviously in Europe, but the US and the rest of the global economy will suffer varying degrees of damage.

If Greece departs from the Eurozone there will be a domino effect, obviously in Europe, but the US and the rest of the global economy will suffer varying degrees of damage.

The Troika and the German government obviously have no Socrates or Aristotle among them but it’s difficult to believe they are as dense as their behavior to this point would suggest. There is reason to expect reason to come to the fore, before a final curtain. However, on the other side we have the Obama Administration, that was strongly advising Merkel to ease up, now taking a hands-off approach. Seemingly, they are giving up.

Greece is also a showcase of the demographics that will inevitably come to even Germany.

UPDATE: An update usually comes after an article has been published. In this case, I was almost ready to publish when news arrived that the Greek government had accepted new terms.

Don’t ask me why they accepted terms that are harsher than the ones the voters overwhelmingly rejected in the referendum. The only issue that might be considered a positive is that the financial support is for a longer term.

I remain convinced that the Germans are actually smart enough to be willing finally to take a haircut to keep the entirety of the Eurozone from unraveling. It would seem the citizenry spoke loudly enough for the government to exhibit a backbone and wait out the Germans. Every additional delay the Germans have accepted was further proof they recognized that the Greeks had to stay in the Zone and were just hoping to wait out the Greek submission. The Germans may have won this battle just to lose the war.

The voters are not happy. They should be furious. More wait and see, until this round plays out and they are all back at square one – again.

.